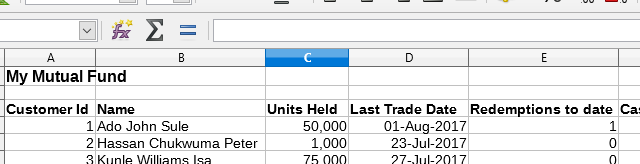

You mean you manage your funds with spreadsheets…?

Spreadsheets in all their forms are great tools. They have revolutionised the data gathering and analysis processes especially when it comes to do with numbers. There are many professionals, not exclusive to the finance sector, to whom spreadsheets are an indispensable tool. If there’s any quick number crunching you need to do, a spreadsheet is your tool of choice.

But when it comes to managing a fund, using a spreadsheet can end up giving you more pain than gain over the long term, especially as the number of funds under your management begin to grow and the number of individual subscribers per fund begin to increase. Let’s give you some of the reasons why…

1. Spreadsheets are notoriously difficult to edit between multiple users

Managing your funds with spreadsheets generally implies you are forced to dedicate the management of that fund to a single staff. It becomes extremely difficult (or impossible) for multiple sales staff to add new subscribers simultaneously, and this means that all requests must be passed to the ‘owner’ of the spreadsheet for update. This individual becomes a bottleneck to the growth of the fund, and ultimately becomes overworked and unhappy.

2. Spreadsheets are simply not meant for capturing and validating transactional data.

Spreadsheets were never meant to be used to track and validate transactional data in real time. They are fantastic for the analysis of historical data… what happened yesterday… plot a graph of this data against that… that’s great. But as a real time data store? Managing data from multiple sources… no.

3. They require human intervention, this slows down automated processes

You have just finished setting up your new online portal to automate fund subscriptions, and because your back end data is stored in a spreadsheet the best you can do is send a mail from the portal when someone subscribes! This completely nullifies the economies of scale that can be achieved by opening up your portals to your customers. It’s all fine when you have 3 subscribers a day, but wouldn’t you want to grow to the point where you have hundreds a day? Spreadsheets won’t help you with that.

4. Over time there’s always the possibility of human error.

The errors might not be intentional, but remember, on a spreadsheet the whole data set is generally accessible. That means a book moved by mistake onto the keyboard while the spreadsheet is open can do wonders to your data. Imagine if you don’t notice that the person who has 1,000 units suddenly has 10,000 units? Now do that four or five times a month over a one year period… and your reconciliation headaches have only just begun!

5. Which brings us to security! security!! security!!!

With spreadsheets, having full audit trails is not practical. Ideally there should be some form of check and balance on the person whose responsibility it is to manage the spreadsheet, and that also won’t be possible. Now consider that if someone else has any reason to work on that same set of data then your spreadsheet gets copied, and now you’re not sure which is the most recent one… hmm… let’s toss a coin! Did I say copied? That’s a security risk in itself. Who knows where that flash drive will end up. In the current era of remote work… security is even more relevant then ever.

Our Symplus Asset Management solution solves each of these issues and more. Manage as many funds as you like with multiple customer service channels and no subscriber limits. You don’t have to wait for days and weeks for your spreadsheets to be updated before you get timely reports on your financial positions, Symplus produces them in real time, every day, with full tracking of historical data. You want to know what the basis for calculating your NAV three months ago was? We’ve got it! Book investments across multiple asset classes in different currencies, with full IFRS compatible integration into the General Ledger? Symplus does that too, and much more.

Now’s the time to switch from your spreadsheets and watch your business grow. Contact us to find out more.